Rate cutting cycles begin in September 2024

The FOMC started the cycle with a 50bps point cut resulting in a positive reaction from the market as the chances of a soft landing increased, and South Africa also saw their first cut with a 25bps cut

Introduction

The main event in September was the Fed starting their rate cutting cycle. The FOMC started the cycle with a 50bps point cut which was expected by half the market while others were anticipating a 25bps cut. The market reacted positively as the chances of a soft landing increased. Generally across the globe, rate cuts are taking place and South Africa also saw their first cut with the MPC announcing a 25bps cut the day after the Fed.

It has also been a good month on the inflation front as the Fed’s preferred measure (PCE) came in slightly lower than expected at 0.1% m/m versus the market expectation of 0.2% m/m. This assists with the soft landing narrative and has helped boost market confidence. The Fed has shifted focus to the labour market as part of their dual mandate and don’t want to see it weakening further. The market is also watching the labour data closely as it looks to plot the Fed’s continued rate path. The latest dot plot reflected a further 50bps of cuts this year.

In addition to global rates moving lower, China has finally implemented aggressive stimulus plans that the markets have responded positively to. This has seen strong share movements from Chinese stocks, resources and the luxury good sector.

Unfortunately geopolitical tensions are escalating around the Middle East with the latest target of Israeli attacks being Lebanon and the loss of life is escalating dramatically. For now, the conflict is isolated to the region; however, tensions are high and there is a concern that it could escalate imminently. Despite this the oil price is actually weakening as the market is anticipating an increase in production from major producers.

The local market has seen some positive momentum as local investors are increasing their allocation to equity following the positive outlook of the GNU. We would still like to see foreign investors flock back to South Africa as this will help lift valuations significantly. There is definitely more positive sentiment around South Africa and the good performance of the JSE combined with the strong ZAR have provided a good investment landscape which has been absent for years. There are still risks on the horizon and the political landscape is fragile but it is good to see the positive news flow.

As we move into the final quarter of 2024 markets appear to have good momentum although valuations are stretched so the focus will be shifting to the upcoming earnings season which we are watching closely.

Macro Environment

The macro environment is focused on various countries rate cutting cycle. Out of the G7 most central banks are cutting rates as inflation comes under control with the outlier being Japan who increased rates and the end of July which drove the Yen carry trade unwind. The UK is expected to cut by a further 25bps this year and the ECB is expected to do the same. However, the ECB is facing some pressure to cut more aggressively as some countries have seen a significant drop in inflation. The US is expected to cut by another 50bps before the end of the year and has two meetings left. Some market participants are pricing in 75bps of cuts by the Fed which would require another 50bps in November. Chairman Powell spoke on 30 September and made it clear the Fed remains influenced by the economic environment. Locally markets expect another 25bps of easing at the meeting on 21 November.

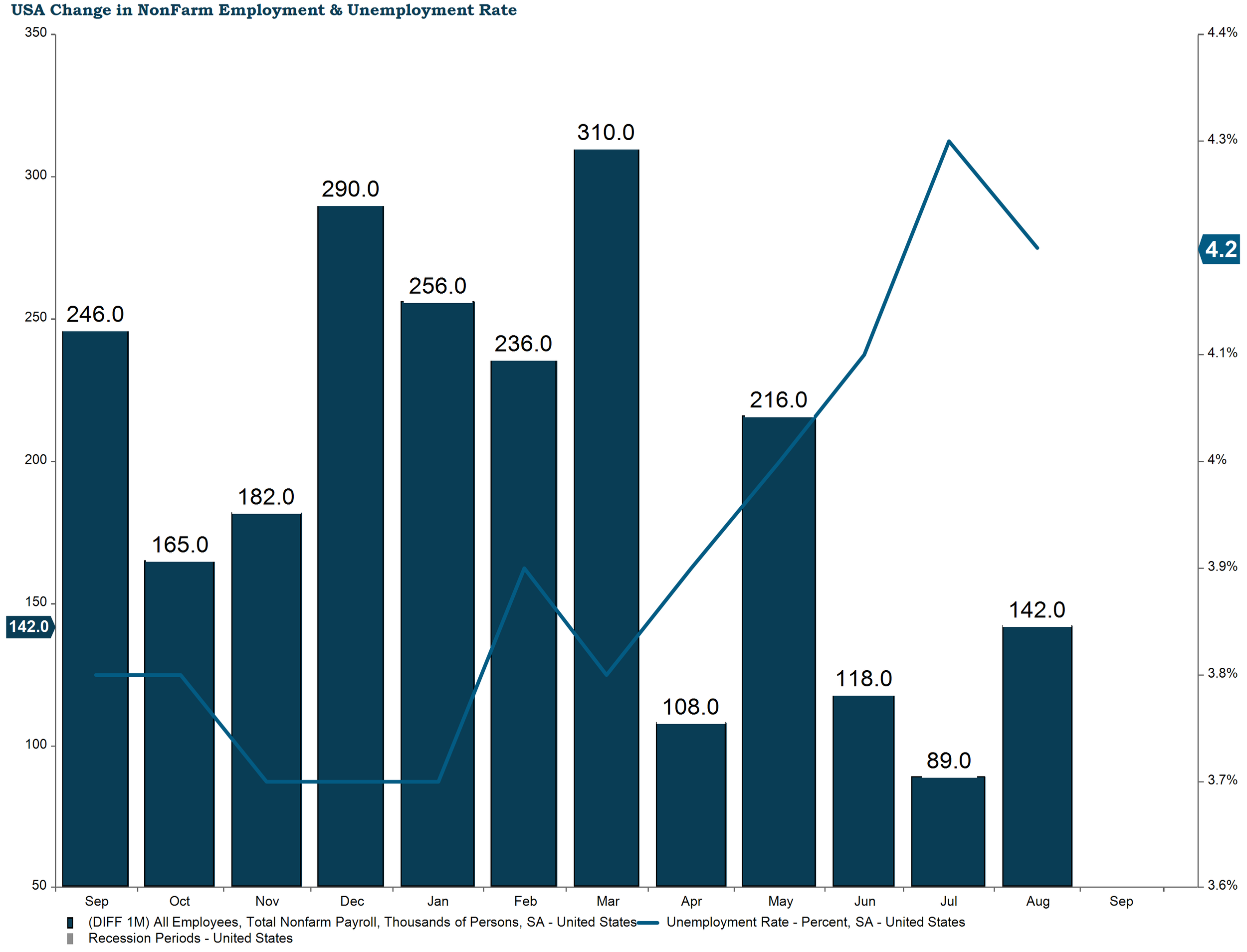

The labour market is a key focus of both the Fed and investors as both have more comfort around inflation, but the labour market needs to remain resilient to allow the soft landing thesis to play out. There is a key focus on the unemployment rate which as outlined by the chart has ticked up. There have also been fewer new jobs created although it must be said the overall labour market in the US still looks very healthy.

Asset Allocation

Our local asset allocation has remained unchanged in September. Our offshore asset allocation saw a change as we exited the NASDAQ short position that was in place to protect portfolios as the soft landing outlook appears promising. Our bond positioning remained unchanged and we maintain our position in structured notes although have migrated our portfolio approach with reference to the notes into a fund which is more efficient for our clients. Overall we are happy with the changes made as they seek to balance risk and reward.

Market Performance

September was a good month for markets generally. During the month of September, the S&P 500 ended up 2.02%. The MSCI World index was up 1.36% for the month and the JSE saw a positive return of 3.34%. As per chart below the YTD performance of the JSE is up 12.56% (in ZAR), while the S&P500 is up 20.81% and the World index is up 17.37% (in USD), respectively.

Bonds

The Bond market continues to be a good place to be following the start of the rate cutting cycle. South African bonds have been a very good performer as they remain attractive from an interest rate differential and benefit from duration as the MPC looks to cut rates. This has resulted in strong flows from offshore investors as emerging markets fall back into favour and SA bonds are attractive from a risk reward basis. This has been positive for portfolios after a tough few years in the local bond market. The chart below highlights the significant move down in yields in SA in the last year.

Equities

The equity market has largely been following macro data during September although we can expect the focus to shift to the upcoming results season where expectations are for EPS growth of 4.6% for the S&P500. This is down from the 7.8% of growth that was expected at the beginning of Q3. This decline in estimates is largely in line with historic trends. Eight out of the eleven sectors are expecting to report gains and it is no surprise that tech shares expect the strongest tailwinds. In line with previous quarters this year we are expecting the AI theme to be in focus although we will likely see a shift from pure commentary around AI and potential benefits to the market wanting to see some numbers. Ultimately the AI theme needs to start reflecting attractive returns as there has been significant investment in the space. We are also expecting discussion around the US election and some uncertainty around the policy outlook as companies prepare for a new President. At DI we are going to be monitoring the rhetoric around labour very closely as this will also provide insights into the macro picture which is influencing the Fed. Earnings outlook as per chart below still looks good and is helping validate the high valuation of the S&P500; however, the expectations need to be met to avoid a repricing.

Conclusion

Markets had a better than expected month in September and are trading on positive momentum. As we enter the final quarter for 2024 we believe portfolios are well positioned to benefit from the soft landing outlook. Should the macro data as well as company results continue the positive trend we could expect the year to close out on a strong note. There are some key risks we are monitoring as we lead up to the US election, heightened geopolitical tensions and lofty valuations so lots going on before year end. The team is available to run through portfolios in the final quarter and positioning into 2025 so please feel free to reach out.

Download Investment Environment Article (PDF, 1MB)