A month of two halves - August 2024

Earning season winds down, and the JSE gains more traction as positive news flow around the GNU helps drive a more optimistic risk sentiment.

Introduction

August was largely a month of two halves with the first half seeing significant volatility and a steep sell off only to have the second half largely reverse the negative trend and bullish sentiment took over. The main concerns centered around a slowdown in the US economy and an increased risk of recession. This rhetoric was driven by a slowdown in ISM Manufacturing as well as a weaker labour report for July. These data points coincided with an unwind of the Japanese Yen carry trade (where investors borrow money, due to the cost of borrowing in Yen being lower at ~1.7%, and invest the proceeds into riskier assets (like equities) to generate a return over and above the cost of borrowing), which put significant pressure on risky assets due to a reversal. As further data points came through during August the markets calmed down on the recession concerns and comfort from the Japanese central bank about the future path of interest rates helped settle concerns around the Yen.

In August we also saw the back end of earnings season with the most anticipated result being Nvidia. Nvidia once again beat market expectations and upgraded their guidance. However, the market has been accustomed to outsized results and the current valuation had a lot of expectations built in which resulted in a small sell off following the result.

The political landscape continues to shift in the US with Democrats officially electing VP Kamala Harris to contest the November 5 election. So far, her campaign is off to a good start raising a record 500mn USD in a month and current polling shows her ahead of Trump. There is still a lot of time until November, but news channels will spend more time focusing on the buildup. From a markets perspective participants will likely look to position for an expected outcome as we get closer to the election although to date the economic policy from both sides is fairly vague and will have a long road to travel so we will only see the true economic impact post the result.

Locally the JSE is starting to gain more traction amongst investors as positive news flow around the GNU has helped drive a more positive risk sentiment. In addition, the ZAR has seen strength as one of the best performing currencies of the year. From a political standpoint there was a big announcement from the EFF as Floyd Shivambu left to join the MK party. The impact is largely unknown but will be interesting to see the performance of these two parties in the next elections.

In offshore markets we are going into September which has traditionally been a poor seasonal month, but we are comfortable with how portfolios are positioned and we took active decisions during August through the volatility that helped protect portfolios while still remaining in the market in order to benefit from the recovery.

Macro Environment

Following an increase in volatility off the back of the growth concerns there was significant focus on the path for the Fed. At their July 31 Meeting the Fed left rates unchanged and in the initial August volatility some participants felt that an intermeeting cut might be required. This was an extreme concern that was quickly dispelled as we were far from an emergency scenario. Chairman Powell spoke at the Jackson Hole Symposium on 23 August and his messaging was clearly more dovish paving the way for a first cut in September. Markets are now trying to predict whether 25bps or 50bps will be cut. This will largely be influenced by additional data coming out prior to the meeting as Powell made it clear they do not want to see the labour market experience further weakening. The Non-Farm Payrolls report comes out on Friday 6 September and this will be scrutinized by market participants as they look to position for the next move by the Fed.

The Non-Farm Payrolls report for July spooked the market as unemployment jumped to 4.3% which was ahead of market expectations of 4.1%. In addition the Nonfarm payrolls rose by 114k which was well below the expectation of 175k. This was a key data point that spooked markets and increased the discussion around recession as the Sahm-rule which has historically been an accurate indicator of recession was triggered where the three month moving average of the unemployment rate is 50bps percentage points above its low over the last 12 months. The next report will be released on Friday 6 September and the market is expecting an increase of 175k and unemployment to be 4.2%.

On Friday 30 August the July PCE (the Fed’s preferred measure of inflation) reading came out reflecting a 0.2% month on month move which was in line with consensus and unchanged from June. From an annualised perspective core PCE came in at 2.6% which was slightly below the 2.7% consensus. Headline PCE 0.2% month on month so it is clear the market is happy with the continued disinflationary trend as illustrated in the chart above.

Asset Allocation

Our local asset allocation has remained unchanged from July following the increase in SA inc exposure. Our offshore asset allocation also remains in line with July although we did down weight our short position on technology in the sell off. Our bond positioning remained unchanged and we continue to roll our structured notes exposure to ensure clients weightings remain in line with the house view. Overall we are happy with the current positioning and believe portfolios are well positioned to ride out some of the expected volatility in September.

Market Performance

August was a good month for equity markets. During the month of August, the S&P500 ended 2.28% up. The MSCI World index was up 1.73% for the month and the JSE saw a return of 1.19%. As per chart below the YTD performance of the JSE is up 8.92% (in ZAR), while the S&P500 is up 18.42% and the World index is up 15.79% (in USD), respectively.

Bonds

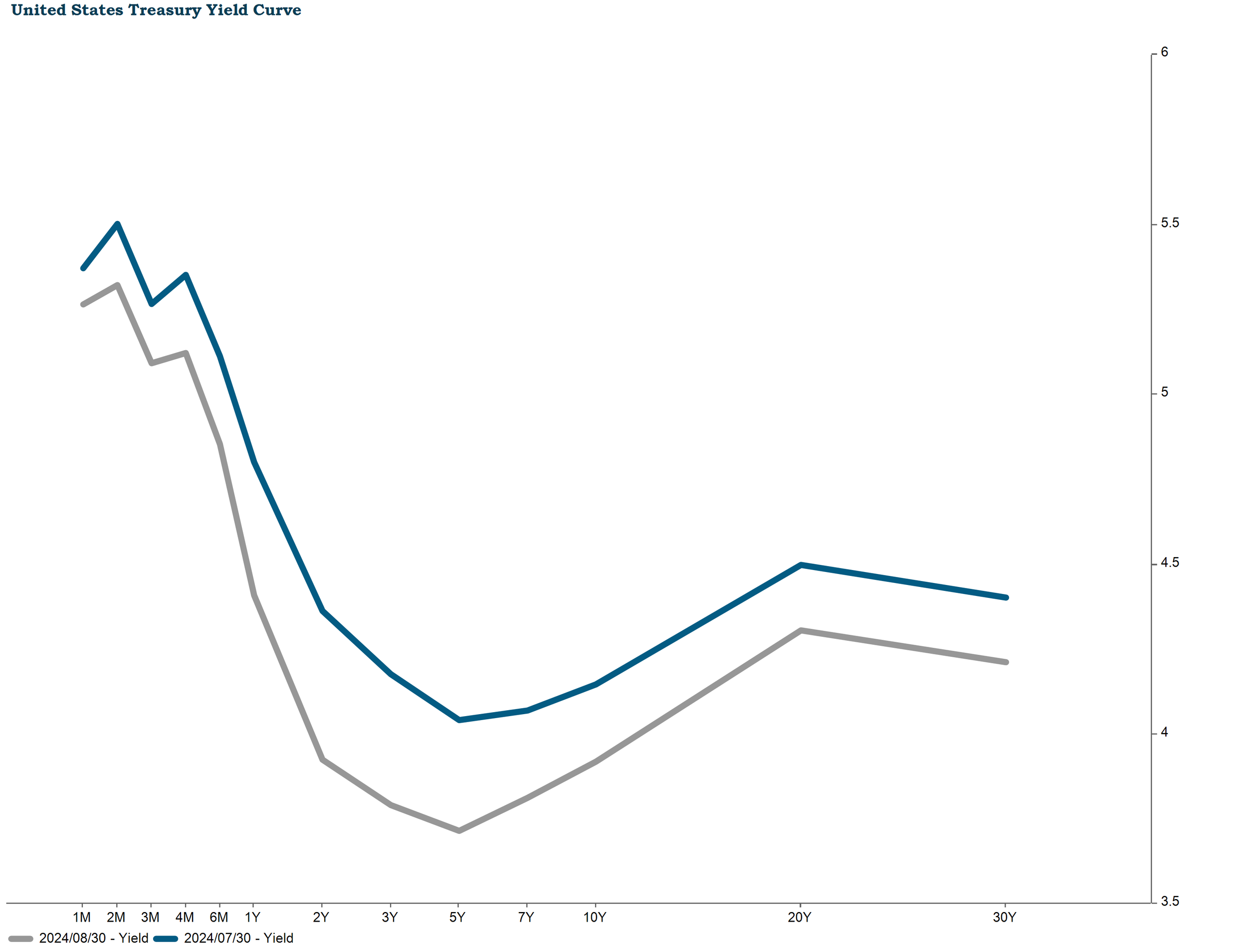

Expectations of a Fed cut and the risk off environment in early August saw a big shift in yields in the US. The yield curve temporarily corrected with the 2-year yield dropping below the 10-year yield. The front end of the curve has seen a sharp drop as rate cut expectations ramp up. This has also resulted in the local market seeing yields drop off and bonds performing well in addition to the more positive risk sentiment on SA. We are comfortable that our positioning of bonds in portfolios as we maintain our view on high quality credit and attractive yields as we move into the rate cutting cycle.

Equities

September is normally a poor month for equities in the US as the seasonality matrix below reflects. Historically September has returned -2.31% on the S&P500. It is interesting to note that historically November has been a good month for equities and although seasonality is not an investment case it emphasizes riding out the bumpy patches. In 2023 we saw a sell off in September and October followed by a strong recovery in November and December. Hopefully we don’t experience the same volatility to end this year but it would not be unusual to see a bit of a pullback before the end of the year.

As earnings season is at an end the focus will largely be on the macroenvironment and relevant data points. The Fed’s next meeting is on the 18th of September however focus on Jobs data and inflation will likely see some market moves before then. Most participants see the NFP report out on 6 September as the most important factor as to whether we see a 25bps or 50bps cut. Markets have largely priced this in so outside of any extreme data points it will likely see a fairly muted response by equities.

Conclusion

Although August started off as a very volatile month markets have calmed down and go into September with a clear focus on the Fed starting their cutting cycle. We anticipate some volatility as macro data remains in focus and the seasonality of September likely sees some pricing pressure. We are comfortable with our asset allocation and underlying holdings and are looking towards the end of the year where if the US economy remains resilient into the cutting cycle the much anticipated soft landing would look to be taking place. This would be good for risky assets and in turn portfolios. The team at DI continues to watch both macro and company specific information closely as we saw in August any disruption to the current thinking applies significant pricing pressure and volatility.

Download Investment Environment Article (PDF, 896KB)